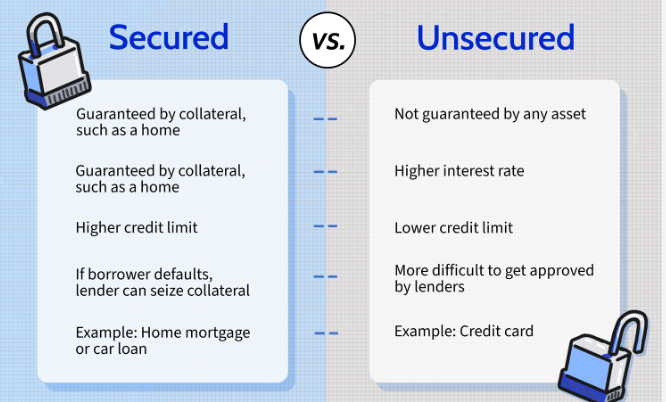

Secured vs. Unsecured Car Loans: What’s the Difference?

When purchasing a car, most buyers will need to take out a loan. However, car loans come in different forms, with two of the most common being secured and unsecured loans. Understanding the differences between these two types of car loans is essential for making an informed decision, as it can impact everything from your … Read more