When purchasing a car, most buyers will need to take out a loan. However, car loans come in different forms, with two of the most common being secured and unsecured loans. Understanding the differences between these two types of car loans is essential for making an informed decision, as it can impact everything from your interest rate to the risk involved in your purchase. In this article, we will explore what secured and unsecured car loans are, how they differ, and the advantages and disadvantages of each.

What Is a Secured Car Loan?

A secured car loan is a type of loan in which the borrower provides the car as collateral to the lender. In other words, the vehicle itself serves as security for the loan. If the borrower fails to repay the loan, the lender has the right to repossess the car to recover the money owed.

This type of loan is most common for car purchases, as the car serves as an asset that the lender can claim if the borrower defaults. Secured loans are typically easier to obtain than unsecured loans and often come with lower interest rates because the lender has the added security of the vehicle.

How Secured Car Loans Work

When you apply for a secured car loan, the lender evaluates the value of the car you plan to buy, your credit history, income, and other factors to determine whether to approve your loan. Since the vehicle is the collateral for the loan, the lender may approve borrowers with lower credit scores or financial histories that may not qualify for an unsecured loan.

The loan is typically paid off in monthly installments over a set period, often between 36 and 72 months. If the borrower defaults on the loan, the lender has the legal right to repossess the car and sell it to recover the remaining debt.

What Is an Unsecured Car Loan?

An unsecured car loan, on the other hand, does not require any collateral. Instead, it is based on the borrower’s creditworthiness and ability to repay the loan. Since the lender does not have any collateral to fall back on in case of default, unsecured loans tend to carry higher interest rates and stricter eligibility requirements.

Unsecured loans are less common for car purchases but may be available through certain lenders or financial institutions. Instead of using the car as collateral, the borrower’s credit score, income, and overall financial situation are used to determine whether the loan will be approved and what terms will be offered.

How Unsecured Car Loans Work

When you apply for an unsecured car loan, the lender will primarily assess your credit score and financial stability. This assessment determines your likelihood of repaying the loan. Without collateral, lenders are taking a greater risk by offering you a loan, which is why they may charge higher interest rates and impose stricter borrowing terms.

Unsecured loans are typically offered for shorter periods, and the loan amounts may be smaller than those of secured loans. Additionally, lenders may require higher credit scores to qualify for unsecured loans since they do not have the security of an asset like the car.

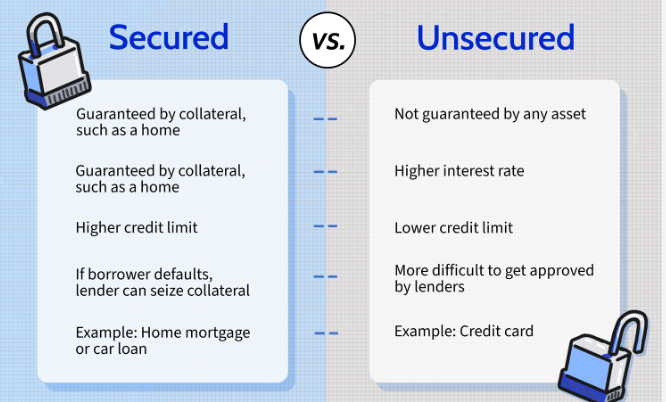

Key Differences Between Secured and Unsecured Car Loans

1. Collateral

- Secured Loan: Requires collateral, which in the case of a car loan is the vehicle being purchased. If the borrower defaults on the loan, the lender can repossess the car.

- Unsecured Loan: Does not require any collateral. The loan is based solely on the borrower’s creditworthiness and ability to repay. If the borrower defaults, the lender may seek legal recourse or take other actions to recover the debt, but they cannot repossess the car.

2. Interest Rates

- Secured Loan: Interest rates for secured car loans are generally lower than for unsecured loans. Since the lender has the security of the vehicle, they take on less risk, which translates into a lower interest rate.

- Unsecured Loan: Interest rates for unsecured car loans are typically higher. Because the lender has no collateral to claim if the borrower defaults, they charge a higher interest rate to compensate for the increased risk.

3. Loan Amount and Terms

- Secured Loan: The loan amount and terms are generally more flexible, and you can often borrow a larger sum of money for a longer period. Secured loans tend to offer longer repayment terms, which can range from 36 to 72 months or even more.

- Unsecured Loan: The loan amount for unsecured loans is typically smaller, and the repayment terms tend to be shorter. This is because unsecured loans carry more risk for the lender, so they typically prefer to limit their exposure.

4. Credit Requirements

- Secured Loan: Lenders may be more lenient when it comes to approving borrowers with less-than-perfect credit. Since the vehicle serves as collateral, lenders are willing to approve loans for borrowers with lower credit scores.

- Unsecured Loan: Unsecured car loans require higher credit scores to qualify. Lenders rely on the borrower’s creditworthiness since they do not have any collateral, making it more difficult for those with poor credit to qualify for an unsecured loan.

5. Risk of Repossession

- Secured Loan: The risk of repossession is a key factor in secured loans. If you default on a secured car loan, the lender has the right to take possession of the vehicle and sell it to recoup the loan amount.

- Unsecured Loan: Since there is no collateral involved, there is no risk of repossession. However, the lender may pursue legal action, including wage garnishment or taking the borrower to court, to recover the loan amount in the event of default.

Pros and Cons of Secured Car Loans

Pros of Secured Car Loans

- Lower Interest Rates: Secured loans generally offer lower interest rates compared to unsecured loans, making them more affordable in the long term.

- Higher Loan Amounts: Lenders are typically willing to approve larger loan amounts since the car is used as collateral.

- Easier to Qualify: Secured loans are often easier to qualify for, especially for borrowers with less-than-perfect credit.

Cons of Secured Car Loans

- Risk of Repossession: If you default on a secured car loan, the lender can repossess your car, which can significantly impact your credit score and financial situation.

- Longer Loan Terms: While longer loan terms can mean lower monthly payments, they can also result in paying more in interest over the life of the loan.

Pros and Cons of Unsecured Car Loans

Pros of Unsecured Car Loans

- No Collateral Required: Since no collateral is needed, you won’t risk losing your car if you face financial difficulties.

- Less Risk: If you default on the loan, the lender cannot repossess your car, although they may pursue other legal actions.

- Quick Access to Funds: Unsecured loans may offer faster approval and access to funds, as they don’t require the extra step of evaluating the collateral.

Cons of Unsecured Car Loans

- Higher Interest Rates: Unsecured loans typically come with higher interest rates since they carry more risk for the lender.

- Stricter Qualification Requirements: Borrowers need a good credit score to qualify for an unsecured car loan. Those with poor credit may not be eligible.

- Smaller Loan Amounts: Unsecured loans tend to have lower loan amounts, making it more challenging to finance the entire cost of the car.

Which Loan Is Right for You?

The choice between a secured and an unsecured car loan depends largely on your financial situation and your risk tolerance.

- Choose a Secured Loan If:

- You want a lower interest rate and can handle the risk of repossession.

- You have less-than-perfect credit and want a larger loan or longer repayment terms.

- You can commit to making timely payments to avoid the risk of losing your vehicle.

- Choose an Unsecured Loan If:

- You don’t want to risk losing your car as collateral.

- You have a strong credit score and can secure favorable terms despite the higher interest rate.

- You prefer a shorter loan term and are willing to accept a smaller loan amount.

Conclusion

Secured and unsecured car loans each have their advantages and drawbacks. Secured loans are more commonly used for car purchases due to lower interest rates and flexible loan terms, but they come with the risk of losing your vehicle if you default. Unsecured loans, while offering no collateral requirement and less risk of repossession, usually come with higher interest rates and more stringent credit requirements.

By understanding the differences between these two types of loans, you can choose the option that best fits your financial situation, helping you secure the car of your dreams while keeping your finances in check.