When it comes to acquiring a new vehicle, there are two main options: leasing and financing. Both of these options have their advantages and drawbacks, and the choice between them depends on your financial situation, driving habits, and long-term goals. Understanding the differences between leasing and financing a car can help you make an informed decision when it comes to your next vehicle purchase.

In this article, we will break down the key differences between leasing and financing a car, including the benefits and downsides of each option, as well as the factors that might influence which choice is best for you.

What is Car Leasing?

Leasing a car is essentially a long-term rental agreement where you pay for the right to drive the vehicle for a specified period—usually 2 to 4 years—while making monthly payments. At the end of the lease term, you return the car to the dealership, and you have the option to lease a new vehicle, buy the car, or walk away.

When you lease a car, you are essentially paying for the vehicle’s depreciation (the reduction in the car’s value over time), plus interest and fees. At the end of the lease, you don’t own the vehicle; you simply return it to the dealer and can either lease a new car or buy the car at its residual value (its estimated worth at the end of the lease).

Key Characteristics of Leasing a Car:

- Lower Monthly Payments: Monthly lease payments are typically lower than monthly financing payments, making it an attractive option for those who prefer to drive a new car every few years.

- Drive a New Car Frequently: Leasing allows you to drive a new car every few years without worrying about selling an old one or dealing with long-term ownership issues.

- Mileage Restrictions: Most leases come with a mileage limit (typically 10,000 to 15,000 miles per year). If you exceed the mileage limit, you may have to pay extra fees for every mile over the limit.

- No Ownership: At the end of the lease, you do not own the car. If you want to keep it, you must buy it at its residual value, which may not be the most cost-effective option.

What is Car Financing?

Financing a car means taking out a loan to purchase the vehicle. When you finance a car, you borrow money from a bank, credit union, or other lender to pay for the car in full (minus any down payment). You then repay the loan over time, typically in monthly installments, until the car is fully paid off. Once you complete all your payments, the car is yours to keep, sell, or trade-in.

Unlike leasing, financing means that you own the car (or are working toward owning it, if you’re still making payments), and you can modify it, drive as much as you want, and keep it for as long as you desire.

Key Characteristics of Financing a Car:

- Ownership: When you finance a car, you own the vehicle outright once the loan is paid off. You are free to keep the car for as long as you want, sell it, or trade it in when you’re ready for a new one.

- Higher Monthly Payments: Monthly payments for financed vehicles are generally higher than lease payments, because you’re paying off the full purchase price of the car, plus interest, rather than just covering the depreciation.

- No Mileage Limits: When you finance a car, you can drive as much as you want without worrying about mileage limits or excess mileage fees.

- Long-Term Costs: Although financing may result in higher monthly payments, you own the car at the end of the loan term, so the long-term cost can be lower compared to leasing, especially if you keep the car for many years after the loan is paid off.

Key Differences Between Leasing and Financing a Car

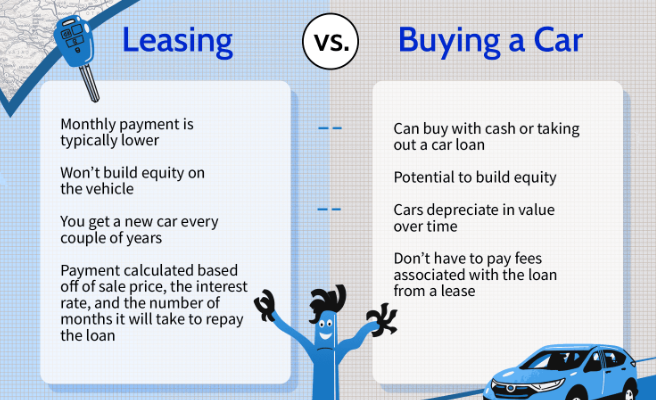

While leasing and financing both offer ways to get into a new car, the fundamental differences between the two options are centered around ownership, monthly payments, vehicle usage, and long-term costs. Below are the key differences to consider when deciding which option is best for you:

1. Ownership

- Leasing: At the end of the lease term, you return the car to the dealership. You do not own the car, and you have to start a new lease or buy the car if you wish to keep it.

- Financing: When you finance a car, you own the vehicle once the loan is paid off. You have full control over the car, including the ability to sell it, trade it in, or modify it as you see fit.

2. Monthly Payments

- Leasing: Lease payments are generally lower than loan payments because you’re only paying for the depreciation of the car during the lease period, not the entire value of the vehicle.

- Financing: Loan payments are typically higher than lease payments because you’re paying off the full value of the car, plus interest, over the term of the loan. However, once you’ve finished making your payments, the car is yours, and you no longer need to make any monthly payments.

3. Mileage Restrictions

- Leasing: Leases come with annual mileage limits, typically between 10,000 and 15,000 miles per year. If you exceed this limit, you may be required to pay a fee for every additional mile you drive.

- Financing: There are no mileage limits when you finance a car, so you can drive as much as you want without worrying about extra fees.

4. Maintenance and Repairs

- Leasing: Lease warranties often cover most of the maintenance and repair costs during the lease term, especially for newer cars. However, you may be required to return the car in good condition, which could involve additional repair or cleaning costs before turning it in.

- Financing: As the owner of the car, you are responsible for all maintenance and repair costs once the warranty expires. However, you can keep the car as long as you want and modify it to your liking.

5. Flexibility and Long-Term Costs

- Leasing: Leasing offers flexibility if you like to drive a new car every few years, but it can be more expensive in the long run if you lease continuously. Since you never own the vehicle, you’re always making monthly payments with no asset to show for it at the end of the term.

- Financing: Financing may involve higher monthly payments, but once the loan is paid off, you own the car and can drive it for many more years without any monthly payments. Over time, this can be more cost-effective than leasing, especially if you keep the car long after the loan is finished.

6. Down Payment

- Leasing: Leasing typically requires a lower down payment compared to financing. Some leases may even offer zero-down payment options, making it easier to get into a new car without a large upfront cost.

- Financing: When you finance a car, you’ll typically need a larger down payment, often ranging from 10% to 20% of the car’s purchase price. A larger down payment can help lower your monthly payments and reduce the total interest paid over the life of the loan.

Which Option is Right for You?

The decision between leasing and financing depends on your personal preferences, driving habits, and long-term goals. Here are some key scenarios to help you decide:

- Lease a Car If:

- You prefer to drive a new car every few years.

- You want lower monthly payments.

- You don’t mind not owning the vehicle at the end of the term.

- You have a predictable driving lifestyle and will stay within the mileage limits.

- Finance a Car If:

- You want to own the car and have long-term control over it.

- You drive a lot of miles and don’t want to worry about excess mileage fees.

- You plan to keep the car for several years, reducing the long-term costs of ownership.

- You are comfortable with higher monthly payments but want the car as an asset once the loan is paid off.

Conclusion

Leasing and financing a car both have their pros and cons, and the right choice for you will depend on your financial situation, lifestyle, and preferences. Leasing is a good option for those who enjoy driving new cars every few years and want lower monthly payments, but it means giving up ownership and facing mileage restrictions. Financing is a better option for those who prefer long-term ownership, unlimited mileage, and the ability to drive the car without monthly payments once the loan is paid off. Carefully weigh the pros and cons of each option before making your decision to ensure that it aligns with your needs and financial goals.