Your health insurance card is a vital piece of documentation that gives you access to essential healthcare services. Whether you’re going for a routine check-up, seeing a specialist, or dealing with an emergency, understanding how to use your health insurance card effectively can save you time, money, and unnecessary confusion. In this article, we’ll explore how to understand the details on your health insurance card, how to use it properly, and what steps to take if you encounter issues with your coverage.

Understanding Your Health Insurance Card

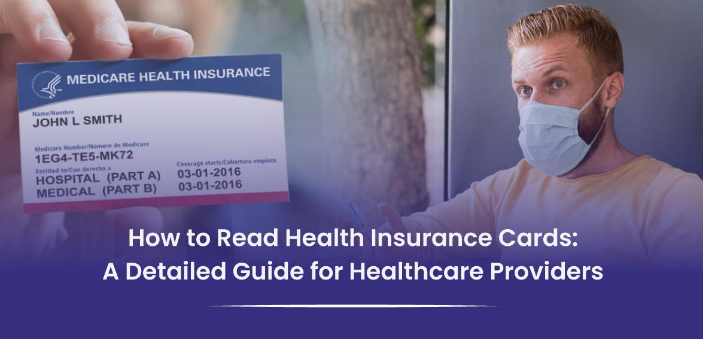

Before you can use your health insurance card effectively, it’s essential to understand what information it contains. Although different insurance providers may have slightly different formats, most health insurance cards feature the same key details. Here’s a breakdown of the common information you’ll find on your health insurance card:

- Member ID Number: Your health insurance card will have a unique member identification number that links you to your health plan. This number is vital when you visit a doctor, pharmacy, or hospital, as it helps providers verify your coverage. Make sure to keep this number secure, as it can also be used for identity theft if it falls into the wrong hands.

- Group Number (if applicable): If your insurance is through your employer or another group, your card may also include a group number. This number helps your insurer identify the specific plan your employer has chosen for you. If you’re on a group plan, you may have access to special benefits or discounts that differ from those available to individuals.

- Name of the Insured: Your name (and sometimes your dependent’s names) will appear on the card. This is to ensure that healthcare providers know whose insurance they are billing and that the services are being provided under the correct plan.

- Plan Type: Your card will typically indicate what type of health insurance plan you have, such as Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), or Exclusive Provider Organization (EPO). The type of plan you have will determine the network of healthcare providers you can visit and whether you need a referral from a primary care physician (PCP) for specialist care.

- Insurance Carrier Information: This section includes the name of the insurance company providing your coverage, such as Blue Cross Blue Shield, Aetna, UnitedHealthcare, etc. The phone number for customer service is often provided as well, in case you need to call the insurer for questions regarding your coverage.

- Coverage Effective Date: The start date of your coverage will also be displayed on your card. This is important to note, as you can only use the card for medical services once your insurance plan is active.

- Co-pays and Coverage Details: Some cards also display key information about co-pays (the amount you pay out of pocket for specific services) and other cost-sharing details. This can help you understand your financial responsibility before receiving services.

- Prescription Information: Some cards also include pharmacy benefits or prescription drug coverage. This section may include information about prescription drug co-pays, formularies, or the pharmacy network.

Using Your Health Insurance Card Effectively

Now that you understand the key elements of your health insurance card, it’s important to know how to use it effectively when you need medical care.

- Presenting Your Card at Doctor Visits: Whenever you visit a doctor, specialist, hospital, or clinic, you should bring your health insurance card with you. The receptionist or front desk staff will need to verify your coverage and collect the details from your card to process the payment. They may make a copy of the card for their records. Be sure to check that the information on your card is correct and matches your current status.

- Understand Your Network: If your health plan is an HMO, PPO, or EPO, you should be aware of which healthcare providers are within your network. Insurance plans often have a list of preferred providers that offer lower costs. If you visit a provider who isn’t in your network, you could face higher out-of-pocket costs. When using your card, it’s important to confirm with the provider that they are part of your network (if necessary), as receiving care outside of the network can lead to unexpected charges.

- HMO: Requires you to see a primary care physician (PCP) first for most services and get a referral to see a specialist.

- PPO/EPO: Offers more flexibility to see specialists without a referral, but seeing out-of-network providers can be more expensive.

- Use Your Insurance Card for Prescription Drugs: If your health plan covers prescription medications, you’ll use your health insurance card at the pharmacy to get your prescriptions filled. Make sure to present the card when you pick up your prescriptions so the pharmacy can apply the correct discount based on your coverage. Some insurance plans have a separate prescription card, but in many cases, your health insurance card will include this information.

- Check for Prior Authorization Requirements: Certain medical services or treatments may require prior authorization from your insurer before they are covered. If you are planning a procedure, test, or specialist consultation, check with your insurance provider ahead of time to determine if pre-authorization is necessary. If you don’t get approval before receiving the service, the insurance company may deny the claim, leaving you responsible for the full cost.

- Verify Coverage for Specific Services: Before undergoing a medical procedure or test, it’s a good idea to verify what’s covered under your insurance plan. For example, many health insurance plans don’t cover certain elective procedures, like cosmetic surgery or non-essential treatments. Review your benefits and use your card to check with your insurer if you’re unsure about coverage. This can help you avoid unexpected charges.

- Emergency Use of Your Insurance Card: In the event of a medical emergency, your health insurance card will provide healthcare providers with essential information to ensure that you receive proper treatment. Emergency rooms and urgent care centers will typically need to verify your insurance information. However, even in emergencies, it’s essential to let the hospital know the details of your coverage, as they will use your card to bill the insurance company for services.

Common Issues and How to Resolve Them

While using your health insurance card may seem straightforward, problems can arise. Here are some common issues and how to resolve them:

- Incorrect Information on Your Card: If your name, address, or other personal details are incorrect, contact your insurance provider immediately. They will be able to issue you a new card with the correct details. This is crucial, as any discrepancies might delay the processing of your claims.

- Denials or Delays in Coverage: If a provider tells you that your health insurance coverage is denied or delayed, ask them to provide you with a reason. It’s also essential to verify the claim with your insurance company. Sometimes, issues arise because of clerical errors, missing documents, or incorrect billing. You can call customer service to resolve the matter and ensure that your claims are processed correctly.

- Understanding Your Co-pays and Deductibles: Some patients are surprised by out-of-pocket expenses when they use their insurance card, especially when it comes to co-pays or deductibles. Before using your insurance card for services, ask your provider about any anticipated costs. They should be able to give you an estimate of what you’ll owe based on your plan. Additionally, familiarize yourself with your plan’s deductible (the amount you pay before your insurer starts to pay) and how it works in conjunction with your co-pays and co-insurance.

- Lost or Stolen Cards: If your health insurance card is lost or stolen, report it to your insurer immediately. They can deactivate the lost card and issue a replacement. In the meantime, you may be able to use your digital insurance card (if offered by your insurer) or receive a temporary card until a new one is sent to you.

Final Thoughts

Your health insurance card is more than just a piece of plastic—it’s your ticket to affordable healthcare services. By understanding the details on your card and knowing how to use it properly, you can avoid confusion, reduce costs, and ensure that you’re receiving the full benefits of your health insurance plan. Always keep your card up to date, carry it with you to all medical appointments, and know how to reach your insurance provider for assistance. With the right knowledge and preparation, you can navigate the healthcare system with confidence and ease.