When it comes to financing a car, choosing the right type of loan is crucial. Car loans are typically divided into two categories: secured and unsecured. Each option has its pros and cons, and understanding the differences between them can help you make an informed decision based on your financial situation, needs, and goals.

In this article, we’ll compare secured and unsecured car loans, explore their respective advantages and disadvantages, and guide you in choosing the best option for your circumstances.

What Are Secured Car Loans?

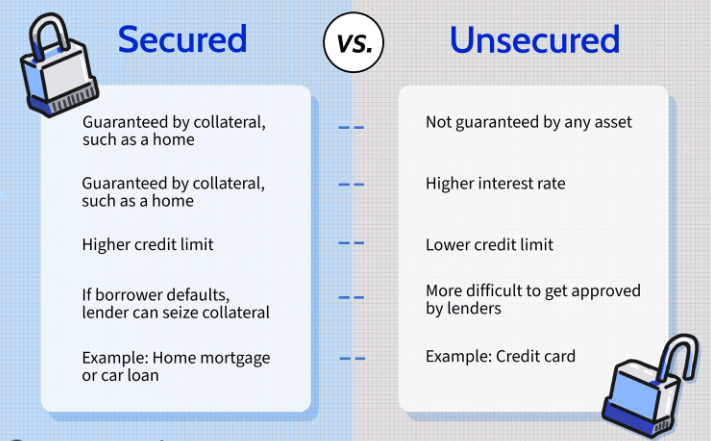

A secured car loan is a type of loan where the car you purchase serves as collateral for the loan. This means that if you fail to repay the loan, the lender has the right to repossess the vehicle to recover their losses. Secured loans are the most common type of car loan, and they are generally offered by banks, credit unions, and other financial institutions.

How Secured Car Loans Work

When you take out a secured car loan, the lender agrees to loan you the money to purchase the car, with the vehicle acting as collateral. The loan terms will include the interest rate, monthly payments, and repayment period. If you default on the loan—meaning you miss payments or fail to repay the loan entirely—the lender can repossess the car and sell it to recoup the outstanding balance.

Benefits of Secured Car Loans

- Lower Interest Rates: Since the loan is secured by the car, lenders consider it less risky. This often leads to lower interest rates compared to unsecured loans, making secured loans more affordable in the long run.

- Higher Loan Amounts: Lenders may be willing to lend you a larger amount of money when the loan is secured by an asset. This can be helpful if you’re purchasing a more expensive car or need a larger loan amount.

- Better Approval Chances: Because the car serves as collateral, lenders are more likely to approve you for a secured loan, even if you have a lower credit score or less-established credit history. This is particularly advantageous for first-time buyers or those with poor credit.

- Flexible Terms: Secured loans often come with more flexible repayment terms, which can make managing monthly payments easier.

Disadvantages of Secured Car Loans

- Risk of Repossession: The biggest risk with a secured car loan is that if you default, the lender can repossess your car. Losing your car can have serious consequences, especially if you rely on it for commuting to work or other essential activities.

- Requires Down Payment: In some cases, lenders may require a down payment when offering a secured car loan. While this isn’t always the case, it can be a hurdle for buyers who don’t have enough saved up.

- Vehicle Depreciation: Cars generally depreciate over time, and if you owe more on your car loan than the car is worth (known as being “upside-down” on your loan), it could be challenging if you need to sell or trade in the car.

What Are Unsecured Car Loans?

An unsecured car loan is a type of loan where the borrower is not required to pledge any collateral—in this case, the car itself—against the loan. This means the lender relies solely on your creditworthiness to determine whether or not to approve the loan. If you default on an unsecured loan, the lender cannot repossess the car but can take other legal actions to recover the money, such as sending the debt to collections or suing for repayment.

How Unsecured Car Loans Work

Unlike secured loans, unsecured car loans do not involve collateral. The lender will approve the loan based on your credit history, income, and other financial factors. Since there’s no collateral involved, these loans tend to carry higher interest rates because the lender assumes more risk. If you default on the loan, the lender can pursue collection actions but cannot take the car directly.

Benefits of Unsecured Car Loans

- No Risk of Repossession: With unsecured car loans, your vehicle is not at risk of repossession if you miss payments. This can provide peace of mind, especially if you’re worried about losing your car in case of financial hardship.

- No Collateral Requirement: Since no collateral is required, you don’t have to worry about putting your car on the line. This can be a good option if you don’t want to risk losing your vehicle.

- Faster Process: Unsecured loans can sometimes be processed more quickly, as there is no need for the lender to assess the value of the car or handle repossession risks. This can be helpful if you’re in a hurry to purchase a car.

- More Flexibility in Loan Terms: Since the lender isn’t tied to a physical asset (the car), they may offer more flexible repayment options and better terms, depending on your creditworthiness.

Disadvantages of Unsecured Car Loans

- Higher Interest Rates: Because there is no collateral securing the loan, unsecured loans generally come with higher interest rates than secured loans. Over the life of the loan, this can result in you paying much more in interest.

- Stricter Approval Criteria: Lenders may have stricter approval criteria for unsecured loans, focusing heavily on your credit score, income, and debt-to-income ratio. If you have poor credit, it may be more difficult to qualify for an unsecured loan or you might receive an offer with a higher interest rate.

- Smaller Loan Amounts: Unsecured loans typically come with smaller loan limits since the lender has no collateral to fall back on if you default. If you need a larger loan for a more expensive car, you may not be able to get approved for an unsecured loan.

- Higher Risk of Default: Without collateral, unsecured loans can be harder to manage if you’re struggling financially. Missing payments can result in severe consequences, including damage to your credit score, collection efforts, or legal action.

Secured vs. Unsecured Car Loans: Which Is Better for You?

Choosing between a secured or unsecured car loan depends on your personal financial situation, credit history, and the amount of risk you’re willing to take. Here’s a breakdown of which option might be best for you:

1. If You Have a Good Credit Score:

- Secured Car Loan: If you have good credit, a secured car loan will likely offer you a lower interest rate and more favorable terms. You’ll benefit from a lower cost of borrowing, and because you can access a larger loan amount, you may have more flexibility when purchasing a car.

- Unsecured Car Loan: While unsecured loans are still an option, they tend to come with higher interest rates for people with good credit. However, if you don’t want to risk putting up your car as collateral, an unsecured loan could be a good choice despite the higher interest rate.

2. If You Have Poor Credit:

- Secured Car Loan: If you have poor credit, a secured car loan is generally your best option. Lenders are more likely to approve you for a secured loan because the car serves as collateral. While the interest rates may still be higher than those offered to borrowers with good credit, the risk for the lender is lower, making approval easier.

- Unsecured Car Loan: Getting approved for an unsecured car loan with poor credit is much more difficult. If you do qualify, expect high interest rates, and you may not be able to borrow as much as you would with a secured loan.

3. If You Want to Avoid Putting Your Car at Risk:

- Unsecured Car Loan: If you’re worried about the risk of repossession, an unsecured loan may be more appealing. With no collateral, you won’t lose your car if you miss a payment—although there are still consequences like damage to your credit and potential legal action.

- Secured Car Loan: If you’re comfortable with using your car as collateral and you have a reliable plan for making payments, a secured loan offers more favorable terms. However, if you default, you risk losing the vehicle.

4. If You Need to Borrow a Large Amount of Money:

- Secured Car Loan: If you need a larger loan to buy a more expensive car, a secured loan is likely the better option. Because the car acts as collateral, lenders are often willing to offer you a larger loan.

- Unsecured Car Loan: Unsecured loans typically come with lower borrowing limits, so they may not be ideal for purchasing a high-end vehicle or financing a larger loan amount.

Conclusion

Both secured and unsecured car loans have their pros and cons. Secured loans are the most common option because they generally offer lower interest rates and higher approval chances. However, they come with the risk of repossession if you miss payments. Unsecured loans, on the other hand, offer peace of mind because there’s no collateral involved, but they tend to come with higher interest rates and stricter approval requirements.

When deciding between secured and unsecured car loans, carefully consider your credit history, financial situation, and willingness to take on risk. By evaluating your options, you can choose the loan type that best fits your needs and helps you achieve your goal of financing a car in the most efficient way possible.