When you buy a home, securing a mortgage is a crucial part of the process. The terms of your mortgage—such as the interest rate, loan duration, and type—will determine how much you’ll pay each month, as well as the total cost of your loan over time. Understanding how these terms influence your monthly payment is essential in making an informed decision about your mortgage and ensuring that it aligns with your financial goals.

In this article, we’ll dive deep into how different mortgage terms impact your monthly payment and explain the factors you need to consider when choosing the right mortgage for your financial situation.

1. The Role of Loan Term Length

The loan term, or the duration over which you agree to pay back the mortgage, is one of the most significant factors in determining your monthly payment. Mortgage terms typically range from 15 years to 30 years, though other options are available in some cases.

Short-Term Mortgages (15-Year Loans)

A 15-year mortgage is a popular option for those who want to pay off their loan more quickly and save on interest payments over the life of the loan. The monthly payment for a 15-year mortgage is typically higher than for a 30-year mortgage because the loan is paid off in half the time.

However, while the monthly payment is higher, the total interest paid over the life of the loan is lower. This makes a 15-year mortgage an attractive option for buyers who can afford the larger payments and want to save money on interest.

Example:

Let’s assume you borrow $300,000 with a 4% interest rate:

- A 30-year mortgage will have a monthly payment of about $1,432 (excluding taxes and insurance).

- A 15-year mortgage will have a monthly payment of around $2,219, but the total interest paid over 15 years will be significantly less.

Long-Term Mortgages (30-Year Loans)

A 30-year mortgage is the most common option and is typically chosen by homeowners looking for a more manageable monthly payment. The longer loan term means that the monthly payments are spread out over a longer period, making them lower. However, this also means you will pay more in interest over the life of the loan.

A 30-year mortgage gives you more flexibility in terms of budgeting, as the lower monthly payment frees up money for other expenses or investments. However, you need to consider the long-term cost—since the loan lasts 30 years, you will pay more interest overall.

Example:

For the same $300,000 loan with a 4% interest rate:

- A 30-year mortgage results in a monthly payment of about $1,432.

- A 15-year mortgage would result in a monthly payment of $2,219, but the total cost of interest would be considerably lower in the long run.

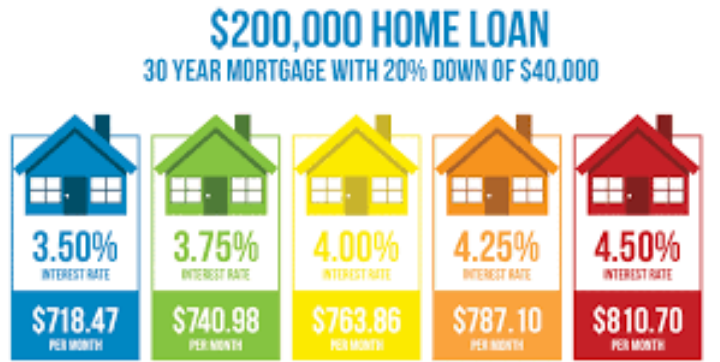

2. Interest Rate Impact

The interest rate on your mortgage plays a central role in determining your monthly payment. The interest rate represents the cost of borrowing, and it’s applied to the loan balance. Mortgage rates fluctuate based on economic factors, and the rate you secure can significantly affect your monthly payment and the total cost of your loan.

Fixed-Rate Mortgages

With a fixed-rate mortgage, your interest rate remains the same throughout the entire term of the loan. This predictability can help you budget effectively because your monthly payment will stay consistent over time, regardless of interest rate changes in the broader economy.

However, securing a lower interest rate early in the loan term means you will pay less in interest over the life of the loan. Conversely, a higher interest rate will increase your monthly payments and overall loan costs.

Adjustable-Rate Mortgages (ARMs)

An adjustable-rate mortgage (ARM) has an interest rate that changes periodically based on the market conditions. ARMs typically offer lower initial interest rates than fixed-rate mortgages, which can result in lower initial monthly payments. However, after an initial period (usually 5, 7, or 10 years), the rate may adjust annually, potentially leading to higher payments in the future.

ARMs are a good choice for buyers who plan to sell or refinance their home before the rate adjusts, but they come with more risk due to the uncertainty of future payment increases.

Example:

If you borrow $300,000 at a 4% interest rate (fixed):

- Your monthly payment for a 30-year fixed mortgage would be $1,432.

- If you have an ARM with an initial 3% rate, the first few years might have a lower monthly payment of around $1,264. However, after the adjustment, your payment could increase depending on market conditions.

3. Down Payment Size and Impact on Monthly Payment

The size of your down payment directly affects your mortgage loan amount, and consequently, your monthly payment. A larger down payment reduces the amount you need to borrow, which lowers your monthly mortgage payment.

Lenders typically require a down payment of at least 3-20% of the home’s purchase price. The more you can put down upfront, the less you’ll have to finance, and the smaller your monthly payment will be.

Private Mortgage Insurance (PMI)

If your down payment is less than 20%, most lenders will require you to pay for private mortgage insurance (PMI), which protects the lender in case you default on the loan. PMI can add $30–$100 or more to your monthly payment depending on the size of your loan and the down payment.

The absence of PMI, which comes with a 20% or higher down payment, helps reduce your overall mortgage costs and may make a big difference in your monthly payment.

4. Loan Type and Mortgage Insurance

The type of mortgage you choose also impacts your monthly payment. Different loan types may come with various eligibility requirements, interest rates, and insurance requirements, which can influence your payment.

FHA Loans

Federal Housing Administration (FHA) loans are often used by first-time homebuyers because they allow for a down payment as low as 3.5%. However, FHA loans also require mortgage insurance premiums (MIP), which can increase your monthly payment. There are both upfront and annual premiums that may be added to your payment.

VA Loans

Veterans Affairs (VA) loans are available to qualified veterans and active-duty service members, and they often come with no down payment requirement and no PMI. This can result in lower monthly payments compared to other loan types. However, some VA loans may require a funding fee, which can be rolled into the loan amount or paid upfront.

USDA Loans

U.S. Department of Agriculture (USDA) loans are available for homes in eligible rural areas and offer low or no down payment requirements. Like FHA loans, USDA loans require mortgage insurance, which can affect the monthly payment.

5. Loan Amount and Monthly Payment

The amount of money you borrow directly correlates with your monthly payment. Larger loan amounts result in higher payments, while smaller loan amounts lead to lower payments. When considering your mortgage terms, think carefully about how much you can comfortably afford to borrow.

In addition to the loan amount, the way the loan is structured (such as the interest rate, term length, and payment frequency) will determine how much you pay each month. A larger loan or a higher interest rate will increase your monthly payment.

Example:

If you take out a mortgage for $300,000 with a 4% interest rate and a 30-year term, your monthly payment would be about $1,432. If the loan amount is $350,000, your payment will rise to approximately $1,675, assuming the interest rate and term stay the same.

6. Other Factors Affecting Your Monthly Payment

Aside from the core mortgage terms, there are other factors that can affect your monthly payment, including:

- Property Taxes: Many mortgage lenders include property taxes in your monthly payment. The lender collects the tax payment along with your mortgage payment and pays the tax on your behalf. Taxes can vary by location and can significantly impact your overall monthly payment.

- Homeowner’s Insurance: Most lenders require that you carry homeowner’s insurance to protect the property in case of damage. The cost of insurance is typically included in your monthly payment, though the amount will depend on factors like the home’s value and location.

- HOA Fees: If your home is located in a community governed by a homeowners association (HOA), you may have monthly or annual HOA fees. These fees can be added to your monthly mortgage payment, which increases your overall payment.

Conclusion

The terms of your mortgage—such as the loan length, interest rate, and down payment—directly affect your monthly payment and the total cost of the loan. Understanding these terms is crucial for determining how much you can afford to borrow and how it will fit into your budget.

A longer loan term results in lower monthly payments but higher overall costs, while a shorter loan term offers the opposite. Interest rates can significantly impact both your monthly payments and long-term loan costs. Additionally, the type of loan, the size of your down payment, and any additional insurance or fees will also influence your payments. By carefully considering these factors, you can choose the mortgage that best aligns with your financial situation and long-term goals.